Another benefit of working with QuickBooks Online is that experts swear by it. Accountants, bookkeepers, and even top finance firms swear by this accounting solution. Before choosing a bookkeeper or financial expert to join your team, it is important to find out if they know how to use your preferred accounting software. Even if you have limited finance experience, you can find the information you need to carry out your basic bookkeeping needs. There are various sample charts of accounts and templates to get you started. Another unique characteristic of the Advanced Plan is that it helps you work smarter.

By using the software you will not have to worry whether your tax report will be made correctly and on time. QuickBooks has established itself as a major player in the small to midsize business accounting market. Whether you’re just starting out or you’re expanding and have more advanced accounting needs, QuickBooks has a solution designed to fit your business. Businesses can also opt to purchase Premier as a “Plus” package through an annual subscription.

The vendors that appear on this list were chosen by subject matter experts on the basis of product quality, wide usage and availability, and positive reputation. Overall, QuickBooks Pro reviews are more favorable, but both user bases have good and bad things to say about each product. Both QuickBooks Online and QuickBooks Pro and Premier have notoriously poor customer support (QuickBooks Enterprise support has better priority support). With QuickBooks Online, you can add QuickBooks Online Payroll starting at $45/month.

There are lots of software out on the market, but nothing matches QuickBooks’ offer. It can save you lots of effort and money, which can be put in good use for the benefit of the company. QuickBooks challenges companies to be oriented towards product innovation and open thinking. By using this software, the company’s productivity will rise, and that will encourage the workers to be open to innovation and to be more focused on making their company better than it is.

Is QuickBooks Online better than Desktop?

You can easily scan and upload receipts in real-time using QuickBooks mobile app, so you don’t need to run helter-skelter to collect them at the time of taxes. If you want, you can also invite them to view the reports themselves and download whatever they need. Tracking inventory as you sell them, Is purchase return a debit or credit entering the details in the right expense account and calculating taxable income at the end of the financial year can be very cumbersome manually. QuickBooks Online was introduced in 2000, and since then, freelancers and business owners have struggled to determine which version is their best bet.

There are also a lot of add-ons and integrations available, so you can connect QuickBooks to other software and tools you use. QuickBooks also has a feature called “class tracking” which allows you to track income and expenses by class. Being able to track your finances by class is a great way to stay organized and keep on top of your business finances. There is a suite of external applications that allows you to customize solutions for your business.

Bonsai even generates analytics and expense reports so that you can monitor and understand your business expenditure over time. With Bonsai, you can arrange your recurring payments and pick a payment medium, whether via bitcoin, credit card, ACH transfer, or PayPal. With Sage, you still get extra services like POS integration, HR tools, sales and marketing, and other eCommerce features.

Best POS Systems For Small Business: 2023 Guide To Choosing The Best POS For Your Small Business

QuickBooks Pro is geared toward small to medium businesses and starts at $549.99/year for a single user. QuickBooks Pro 2023 must be purchased through a reseller or a phone call with QuickBooks Sales. QuickBooks Online is a more attractive option for budget-conscious small business owners looking for a flexible software solution.

On the off chance that you are getting QuickBooks error 1603, you cannot get to the financial software and this can prompt an expected financial loss. There could be various purposes behind the error 1603 like damaged or incomplete installation files, missing Windows installer parts, etc. The efficiency of your work might hamper if your QuickBooks is unable to start or QuickBooks running delayed on your PC. The issue emerges assuming the number of users marked into the company document in double increments. The error will make an issue for the user when you will attempt to open a company file that isn’t situated on your PC framework.

- You can also let them know when they have solicitations they need to pay you for.

- They are all both different types of account management software (AMS), an important tool for both businesses and individuals that across various financial processes.

- This will not affect the overall time data stays in the product; that remains unchanged.

- For example, you won’t be able to go back to a point where the last transaction data is available unless you’re on the highest pricing plan.

- You can further develop user care by joining all appeals implied for a single user into one email by simply looking at a container.

You can then click on a link that says, “Moving to QuickBooks Desktop? Learn More.” This will guide you through exporting your data and creating a backup company file. QuickBooks Online has a cheaper monthly cost and is more affordable if you have a lot of employees who will be using the software. QuickBooks Desktop Pro may be cheaper if you do not need additional users or add-ons such as payroll.

Are There Disadvantages of Using QuickBooks Online?

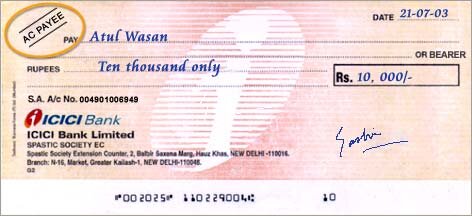

Another benefit of QuickBooks is in the availability of ready-to-use templates to create charts, business plans, invoices and spreadsheets. It can also help save time and effort for business owners by automating their signatures (which is scanned and uploaded for use) on business checks. Integration with other applications is also a big advantage of QuickBooks. It has a user-friendly interface and can guide users through each of its features.

This way, the customer or supplier can pay your invoice in their local currency. Features are geared towards freelancers, small, and medium-sized business owners. In addition to some native QuickBooks Online integrations—such as QuickBooks Payroll, QuickBooks Time, and QuickBooks Payments—QuickBooks Online connects with popular apps. These include PayPal, Melio, HubSpot, Expensify, LeanLaw, Square Payroll, and Expensify.

QuickBooks Online VS Desktop: Pricing

Intuit has developed desktop products and online products to meet various types of business needs. After you sign up for QuickBooks Online, you’ll be able to log in to your account and access the main dashboard view. If you’re moving to QuickBooks from another accounting software, you can import your existing files to your new account. Our partners cannot pay us to guarantee favorable reviews of their products or services. Intuit, the company that owns QuickBooks, sells lots of software and apps.

Choose Whether you Want to Chat or Request a CallBack

QuickBooks Desktop, meanwhile, allows for the calculation of job costs and individual customer discounts. The price of QuickBooks programs depends on the program you choose and the features you need. The basic QuickBooks Online plan starts at $25 per month, while the more advanced plans start at $70 per month. You can also purchase QuickBooks Desktop software for a one-time fee of $299.99. If you run a small or medium-size business and want to ensure you can track all financial information and create reports summarizing any aspect of your business, QuickBooks will not disappoint. Just be aware that there is a learning curve when starting out, and not all features are intuitive when you get the program up and running for the first time.

QuickBooks Online offers over 80 reports depending on your plan, whereas QuickBooks Desktop Pro has over 130 reports. QuickBooks Desktop Premier and Quickbooks Desktop Enterprise have even more reports (especially if you opt for the industry-specific versions of these programs). A cloud accounting software is similar to traditional accounting software which is hosted on remote servers (similar to SaaS). Data is sent into a cloud where it is processed and returned to the user.

However, the function recognizes only three fields – Date, Description, and Amount. If the transactions you want to import already include categories, memos, check numbers, and any split information, that information will be ignored. The only way to add that information is to edit each imported transaction manually after importing CSV files.